Trading bots are automated trading algorithms designed to trade cryptocurrencies on behalf of their users. They have become increasingly popular in recent years due to their ability to help traders automate their trading strategies, reduce the time they spend monitoring the market, and make trading decisions based on objective criteria. In this blog post, we will explore what trading bots are and how you can create and use them on Bybit.

What is a Trading Bot?

A trading bot is a computer program that uses mathematical algorithms and market data to automate the trading process. The main goal of a trading bot is to execute trades on behalf of its users based on pre-defined criteria and rules. Trading bots can be programmed to follow a wide range of strategies, including market-making, scalping, swing trading, and others. They can also be programmed to execute trades based on technical indicators, price patterns, and market data.

Types of Trading Bots on Bybit

Bybit offers three different types of trading bots: spot grid bots, DCA bots, and futures grid bots. Each type of bot is designed to cater to a specific type of trading strategy.

1. Spot Grid Bots

Spot grid bots are designed for traders who want to implement grid trading strategies in the spot market. These bots help traders to buy low and sell high using grid-based entry and exit strategies.

As an example, let's say the current price of Bitcoin is $22,000, and you have invested $1,000 with the following settings: an upper price of $24,000, a lower price of $20,000, and four grids. If the price of Bitcoin drops to $20,000 and then rises to $24,000, the bot would execute the following trades:

A. Buy Bitcoin at $21,000 for $500

B. Buy Bitcoin at $20,000 for $500

C. Sell half of the Bitcoin at $23,000

D. Sell the remaining Bitcoin at $24,000.

Note: This is a simplified example, and actual trading results may vary depending on market conditions and other factors.

2. DCA Bots

DCA bots are designed for those who want to trade using the dollar-cost averaging (DCA) strategy. This strategy involves buying a fixed dollar amount of an asset at regular intervals, regardless of the asset's price. The goal of a DCA bot is to help traders average out their entry price over time and reduce the impact of market volatility on their investments.

3. Futures Grid Bots

Futures grid bots are designed for futures traders who want to trade using grid trading strategies. These bots can help traders execute trades based on predefined criteria, such as price levels and order size.

How to Create and Use Trading Bots on Bybit

Bybit makes it easy to create and use trading bots. To get started, simply sign up for a Bybit account(Sign up to Bybit with this link to get a 20% discount on trading fees), log in to the trading bot platform. and go to the Trading Bot section.

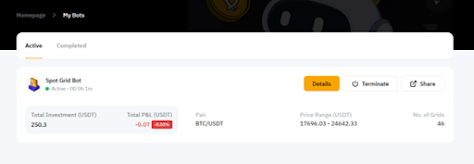

From there, you can create a new bot, select your preferred strategy, and customize your bot's parameters to suit your trading needs.

Once you have successfully set up your bot on the Bybit platform, you will have the ability to take advantage of its advanced features and customization options. With a highly flexible interface, you have the ability to adjust your bot's settings at any moment, ensuring that it is always working to meet your specific needs and goals.

In conclusion, trading bots are a valuable tool for traders who want to automate their trading strategies and save time. Bybit offers a user-friendly trading bot platform that makes it easy to create and use trading bots, regardless of your trading experience. Whether you are a seasoned trader or just starting out, Bybit's trading bots can help you maximize your profits and minimize your risks.

👉 Sign up to Bybit and enjoy a 20% reduction in trading fees

No comments:

Post a Comment